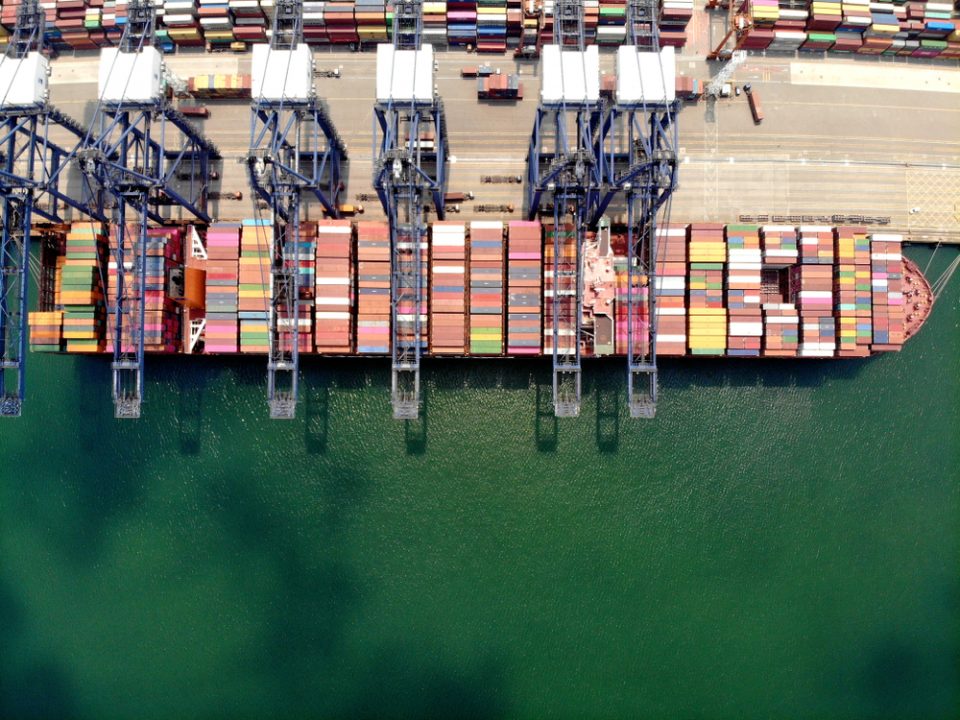

Air & Sea Freight Forwarding Timeline

August 19, 2019

How Chinese New Year Affects Freight Forwarding

October 21, 2019Currently, America and China are engaged in a trade war. This economic conflict is made up of tariffs and trade barriers that are imposed on imports and exports between the United States and China. This war was initiated by the United States when President Donald Trump called for more aggressive tariffs on China to encourage China to change their trading policies with the United States. These tariffs are constantly being updated and changed, but overall they are making trade with China more difficult. For companies that import to or export from China, understanding these tariffs and staying updated on new tariff lists is vital to your international strategy.

What is the Current Status of the United States Tariffs on China?

So far there are four extensive lists of tariffs for goods with China. China has imposed countermeasures tariffs and other nations and trade groups have also instilled their countermeasures. Aside from the China-specific tariffs, the United States has imposed a global 10% tariff on aluminum & a 25% tariff on steel. This went into effect on March 23rd. Mexico, the EU, Turkey, Canada, and India have all created their own countermeasures to the recent global and China-specific tariffs that America employed in 2018. Initially, the United States imposed tariffs on $34 billion worth of Chinese imports, but after China’s countermeasure, the United States proposed tariffs on an additional $16 billion worth of Chinese imports. The United States then proposed their third list of tariffs that would account for $200 billion worth of Chinese imports. The fourth tariff list became effective on September 1st, 2019, and included 15% tariffs on a variety of goods. The fourth list has an addendum that is being added on December 15th of this year.

What Goods & Chinese Imports Fall Under These Tariffs?

The tariffs on Chinese imports cover everything from livestock to clothing to machinery, to instruments. Some items were removed from the tariff lists via petition. These items included some fish, chemical compounds, religious books, and child safety seats. These lists are constantly being updated as companies petition for certain goods to be removed off of the list. To date, there have been 48 product-specific exclusions to list one’s tariffs, 158 exclusions to list 2, 634 more exclusions that are currently being rolled out with another thousand exclusions pending. All of these lists are constantly fluctuating and will continue to be updated.

How Bruning International Can Help Navigate Tariffs

At Bruning International, we are dedicated to helping companies navigate complex logistical systems when receiving imports and exporting goods. The Chinese tariffs affect a lot more than just trade between the United States and China, which is why our team closely monitors every detail to ensure that our clients can effectively conduct their business. If you have questions about shipping to/from China, contact us. Our team can help your company understand and ship more efficiently around the world. Fill out the form below to download copies of all the Chinese Tariff lists to date.